|

Getting your Trinity Audio player ready...

|

December 22, 2025

Market Growth

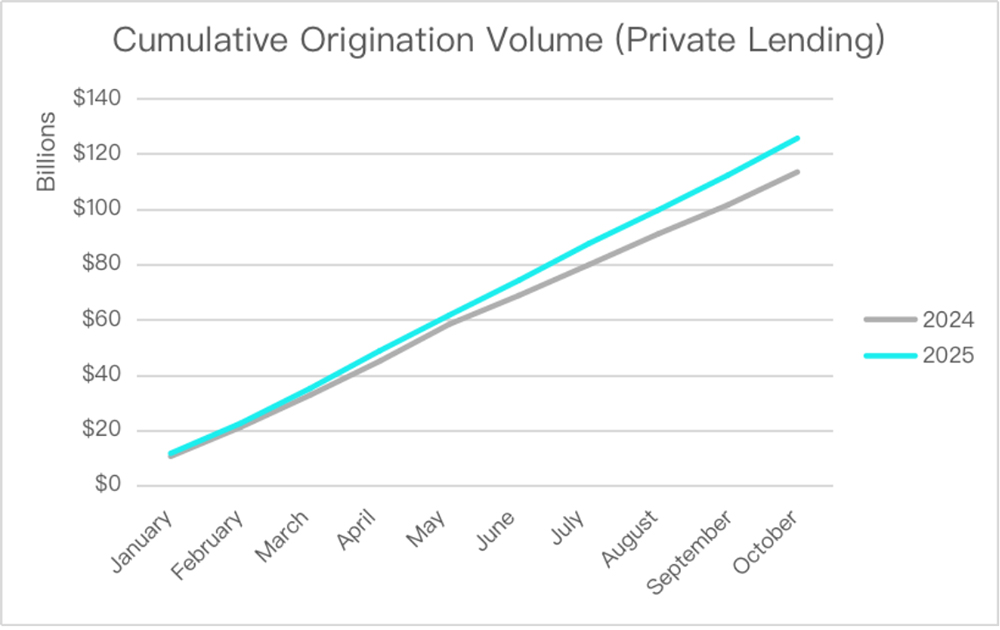

The private lending market for real estate continues to demonstrate robust growth and remarkable fragmentation, with over $125 billion in loan originations through the first ten months of 2025.

From January through October 2025, private lenders originated approximately 238,600 loans totaling $125.6 billion. This represents an 11% increase in dollar volume and 9% growth in loan count compared to the same period in 2024, signaling continued momentum in the private lending sector despite broader economic headwinds.

A Highly Fragmented Market

The private lending market is highly disaggregated. Nearly 13,631 active lenders competed for business through October 2025, up from 11,626 in the prior year (17% increase).

The market’s structure reveals just how dispersed lending activity remains. The top 10 lenders by volume captured 21% of total originations, while the top 10 by loan count originated 25% of all private loans.

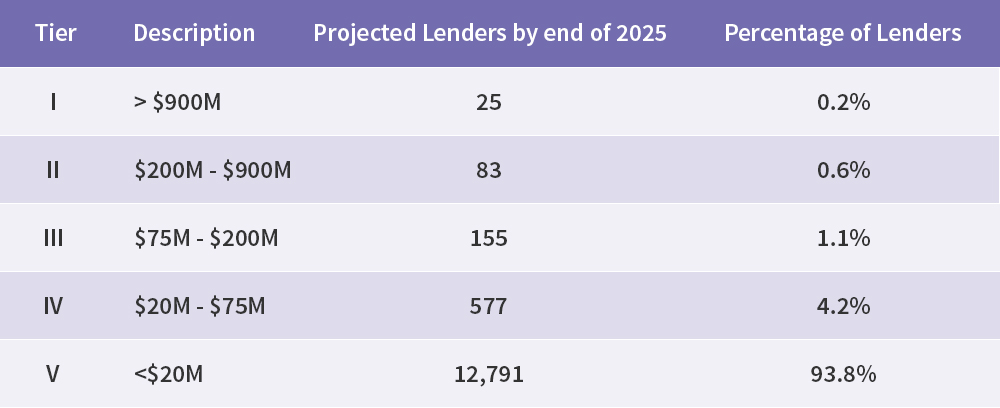

Private Lender Tiers by Yearly Origination Volume

We classify lenders into different tiers based on yearly origination volume.

Using origination data from January to October, we can project how many lenders should fall within each bucket and analyze their activity in the first ten months. The projected 25 largest lenders (those projecting over $900 million in annual volume) originated 81,930 loans worth $40.7 billion through October. These Tier 1 players represent 0.2% of all lenders but account for roughly one-third of total market activity.

At the opposite end, over 12,700 smaller lenders with projected annual volumes below $20 million collectively originated 64,357 loans totaling $24 billion through October 2025. This long tail of micro and regional lenders demonstrates the market’s accessibility to specialized players serving niche geographies or borrower segments.

Loan Duration Patterns

The market maintains a roughly 60/40 split favoring short-term products, with 60% of loans carrying terms of five years or less. These bridge loans, fix-and-flip financing, and other short-duration products represent the traditional business of private lending, serving borrowers with time-sensitive needs or properties requiring renovation. The remaining 40% consists of longer-term financing exceeding five years, competing in what was once the exclusive domain of traditional mortgage providers.

Emerging Lenders

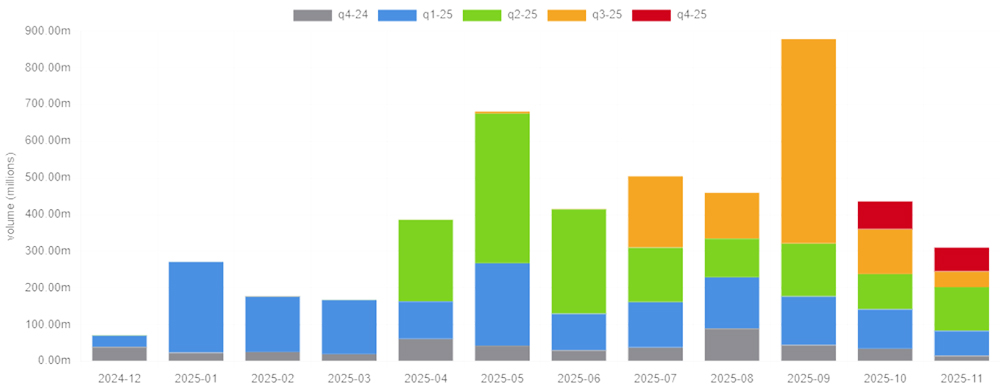

Above graph shows origination volume for Private Lenders tagged as “Emerging Lenders”. Each color represents when they “emerged”.

The private lending industry experiences new entrants on a daily basis across the country. Some of these “Emerging Lenders” may be brokers converting to direct lenders or startups who have experience from other private lenders, or converting from conventional lenders. Regardless of backgrounds, the magnitude of new entrants is an interesting dynamic to follow. YTD 2025, Forecasa has identified over 1,400 Emerging Private Lenders (500+ just in Q2-25 alone). Some of these lenders may have only funded a handful of loans, but others quickly grow origination volume from Tier 5 to Tier 4 and beyond. A small percentage of these Emerging Lenders have capital market strategies in place, but many are looking for capital partners to grow and expand into new markets.

The private lending market’s continued expansion, both in total volume and number of active participants, shows a strong underlying demand for alternative financing solutions. Private lenders have carved out a substantial and growing niche in real estate finance.

Michael Fogliano

Product Manager at Forecasa

Click to contact

He specializes in data analysis and research for the private lending real estate market. His work focuses on building data models and analytics products that uncover market insights and enable better decision making.