|

Getting your Trinity Audio player ready...

|

October 16, 2025

The Deal at a Glance

- Property Type:8-unit multifamily

- Location:Brooklyn, New York

- Loan Amount:$2,273,000

- Term:30 years

- Structure:5-year fixed, interest-only

- Closing Time:30 days

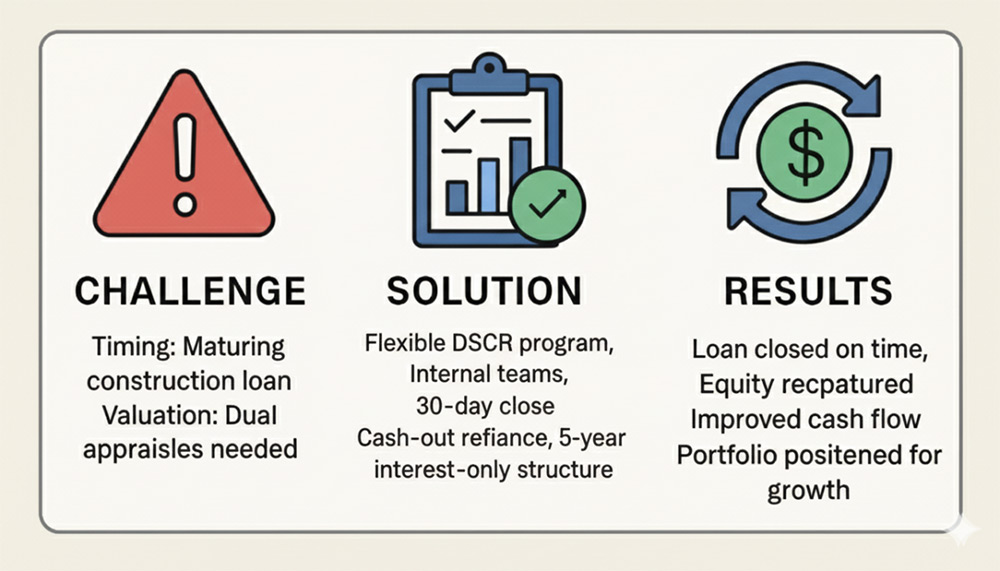

The Challenge

A long-term client was facing a maturing construction loan on a fully renovated 8-unit building in Brooklyn.

If the refinance didn’t close in time, they risked default and costly penalties.

Two major obstacles stood in the way:

- Timing:The note was maturing at the end of the month.

- Valuation:Because of the high loan amount, dual appraisals were required to confirm value — adding complexity and potential delays.

On top of this, the borrower wanted not only to pay off the existing note but also to pull out cash to fund their next investment.

The Turning Point

RBI Private Lending leveraged its flexible DSCR program and strong internal underwriting and processing teams to get the deal done in under 30 days — meeting the deadline and avoiding default.

The ability to move quickly and structure a loan aligned with the borrower’s investment goals was critical.

The Financing Strategy

– Interest-Only Structure:

The borrower secured a 5-year interest-only period, lowering monthly payments and improving cash flow.

➝ This gave them more liquidity to invest in other projects.

– Cash-Out Refinance:

Instead of selling the property to access capital, the borrower tapped into existing equity, unlocking funds for future deals.

➝ This allowed the portfolio to grow without sacrificing assets.

– Permanent Loan:

Transitioning from a short-term construction loan to a long-term, 30-year structure provided stability and predictability.

The Outcome

- Loan closed on time — avoiding maturity default.

- Borrower paid off the existing note.

- Equity was recaptured through cash-out.

- Cash flow improved via interest-only structure.

- Portfolio positioned for continued expansion in the NYC metro area.

Lessons Learned

- Timing is everything: When a maturity date is approaching, speed and execution make the difference.

- Cash-out can fuel growth: Refinancing allows investors to access capital without selling.

- Structure strategically: Interest-only periods improve liquidity and flexibility, though principal remains.

Key Takeaway for Loan Officers

When advising borrowers:

- Map out debt maturity timelines

- Identify equity extraction opportunitiesthrough cash-out refinance.

- Evaluate if an interest-only structurealigns with the borrower’s short-term investment strategy.

A refinance is not just a solution to a problem — it can be a strategic lever for growth.

Matthew Lamm

Account Executive at RBI Private Lending

Matthew Lamm is an Account Executive at RBI Private Lending, specializing in DSCR loans and strategic financing solutions for real estate investors. With a strong focus on recapitalization and refinance strategies, he helps clients optimize cash flow, unlock equity, and scale their portfolios in competitive urban markets.