November 25, 2025

Bridge lending showed a rebound in October after several months of declining volume, while DSCR loans set yet another record high on Lightning Docs. As new markets continue to emerge across the country, lenders are finding opportunities for growth in regions that were once off the radar.

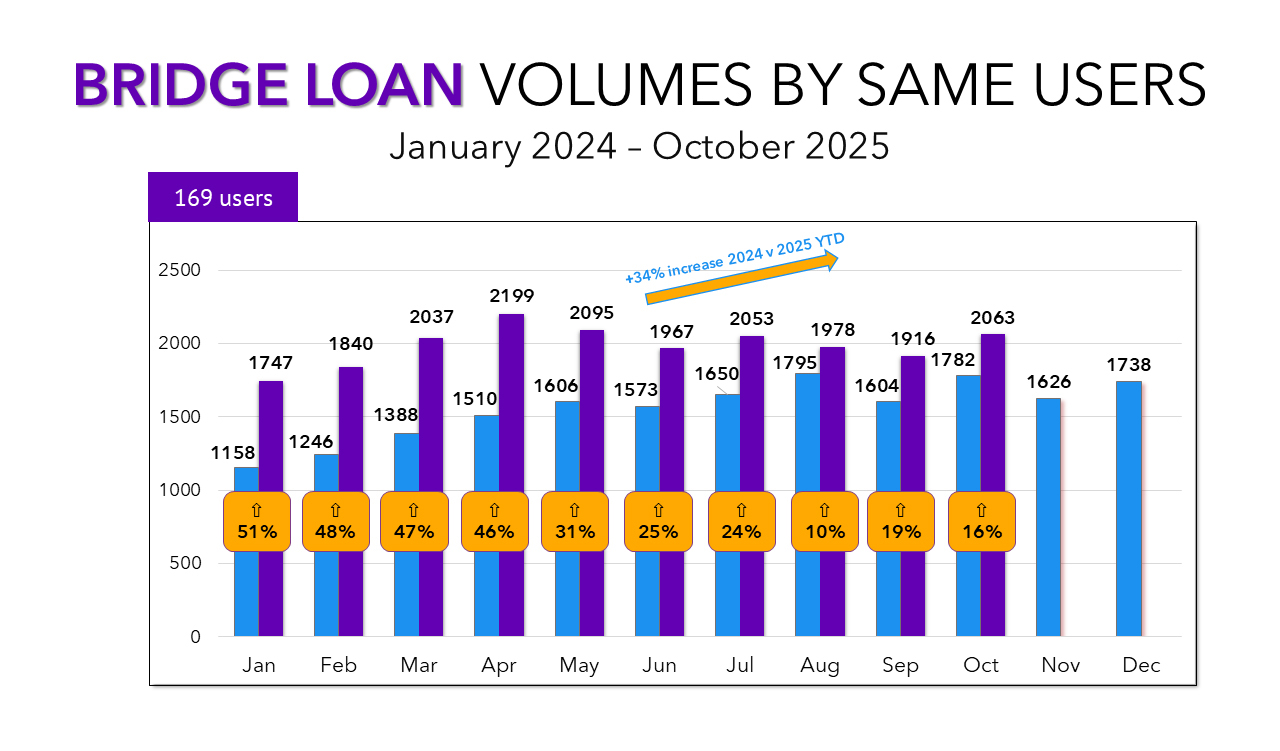

Bridge Lending Sees Its First Uptick Since July

Bridge loan transactions increased 6% month-over-month, marking the first gain since July. While volumes haven’t quite yet returned to the highs of the spring, this rebound signals a pause in the steady decline we’ve seen through the second half of the year.

DSCR Lending Continues Its Surge

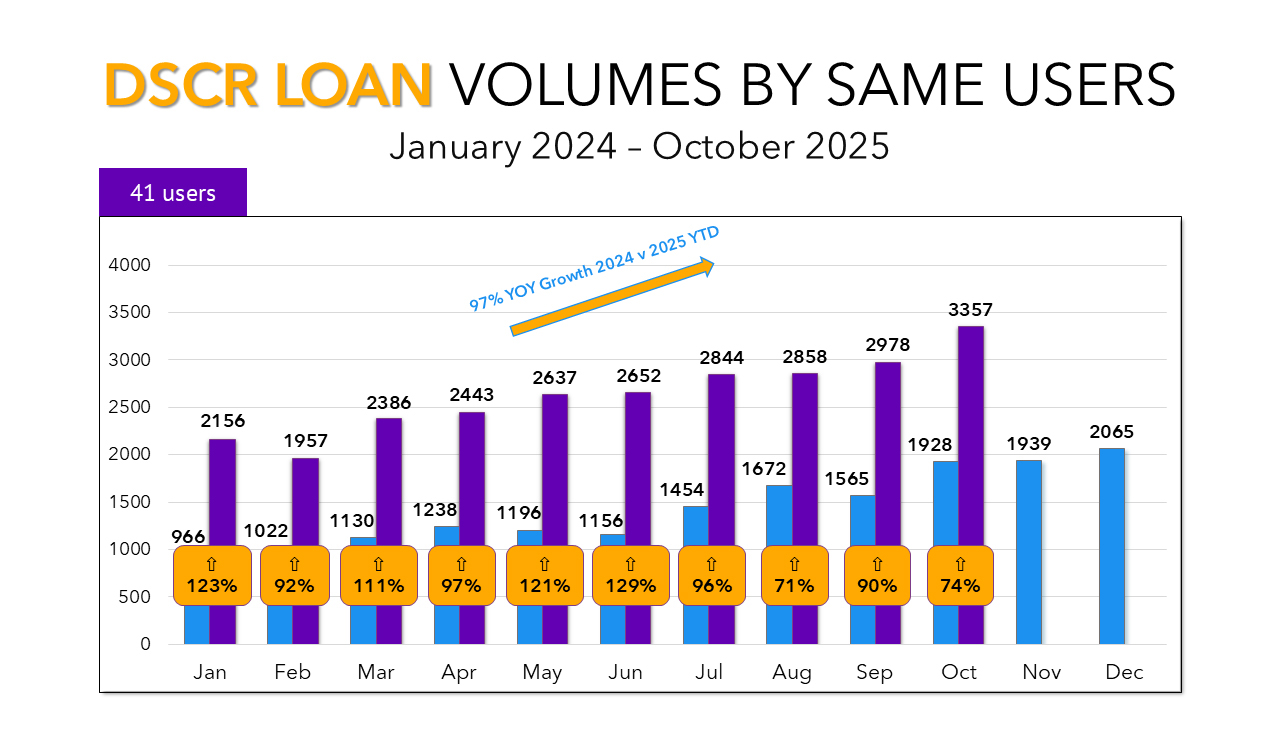

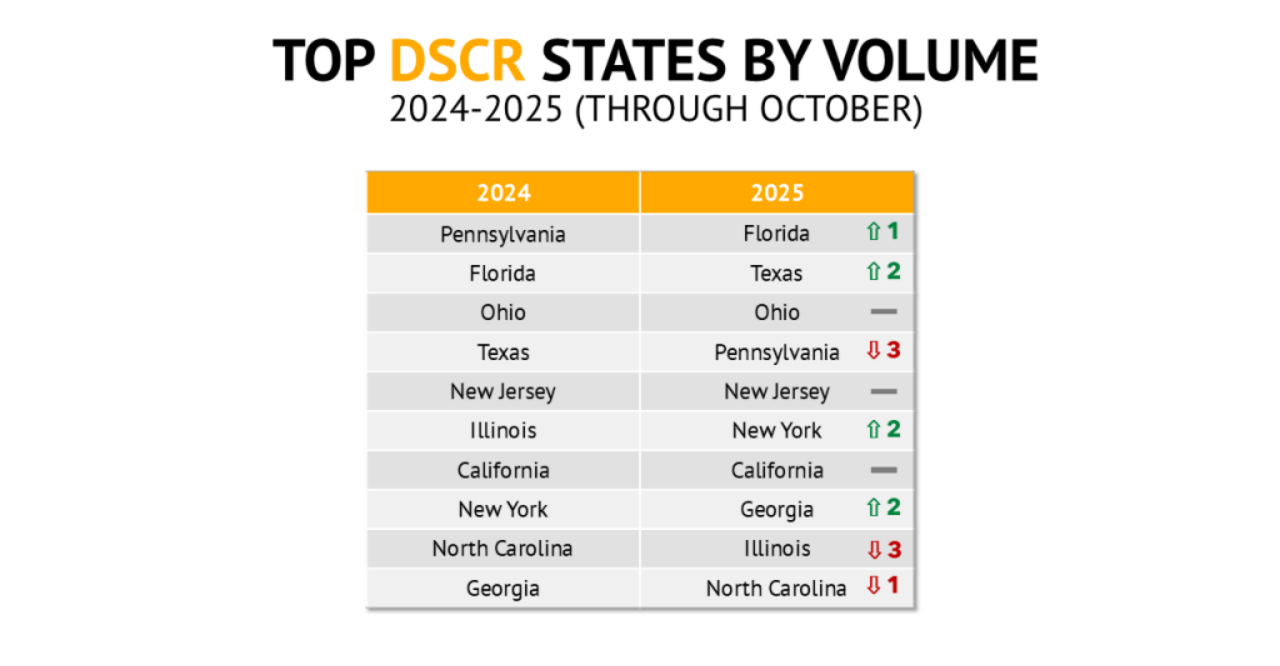

I’m tired of writing it, you’re tired of reading it, but the fact is DSCR transactions continue to surge. Lightning Docs users with us since the start of 2024 crossed the 3,000-loan threshold for the first time in October, reaching 3,357 total DSCR loans—an increase of 13% month-over-month, the largest jump since March. Lenders who’ve leaned into this segment continue to see strong results

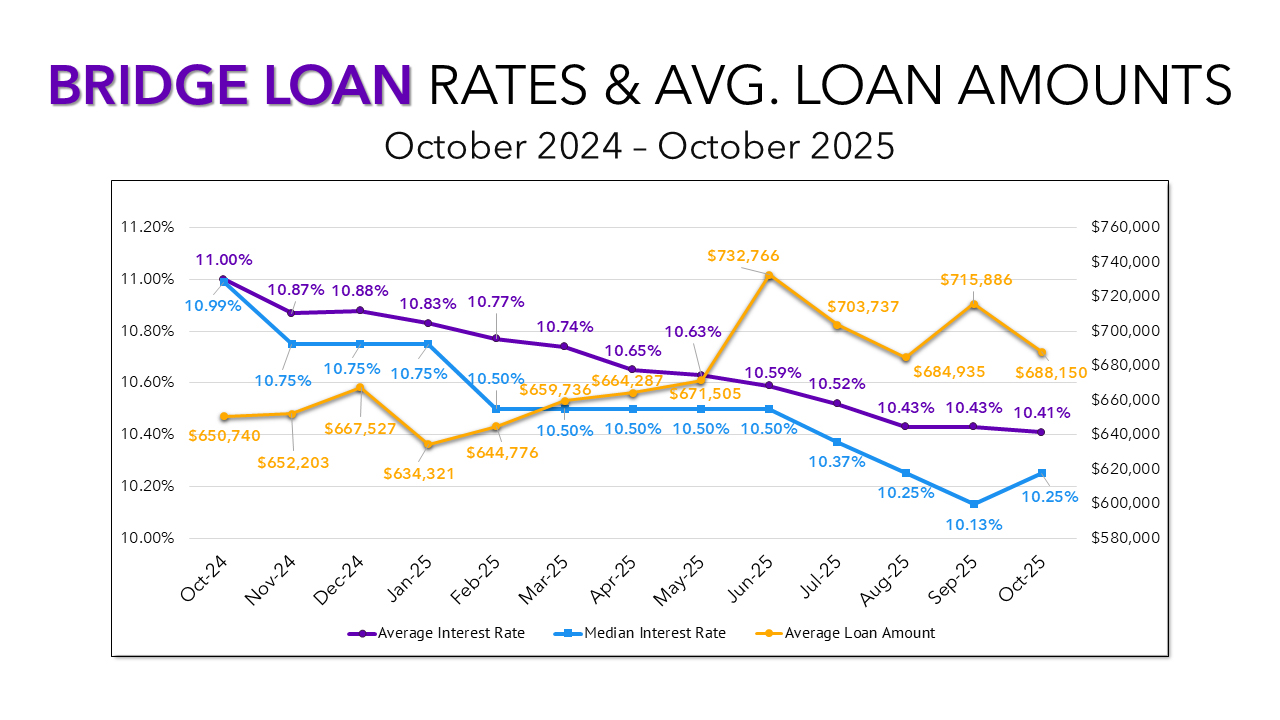

Rates Continue to Drop Across the Board

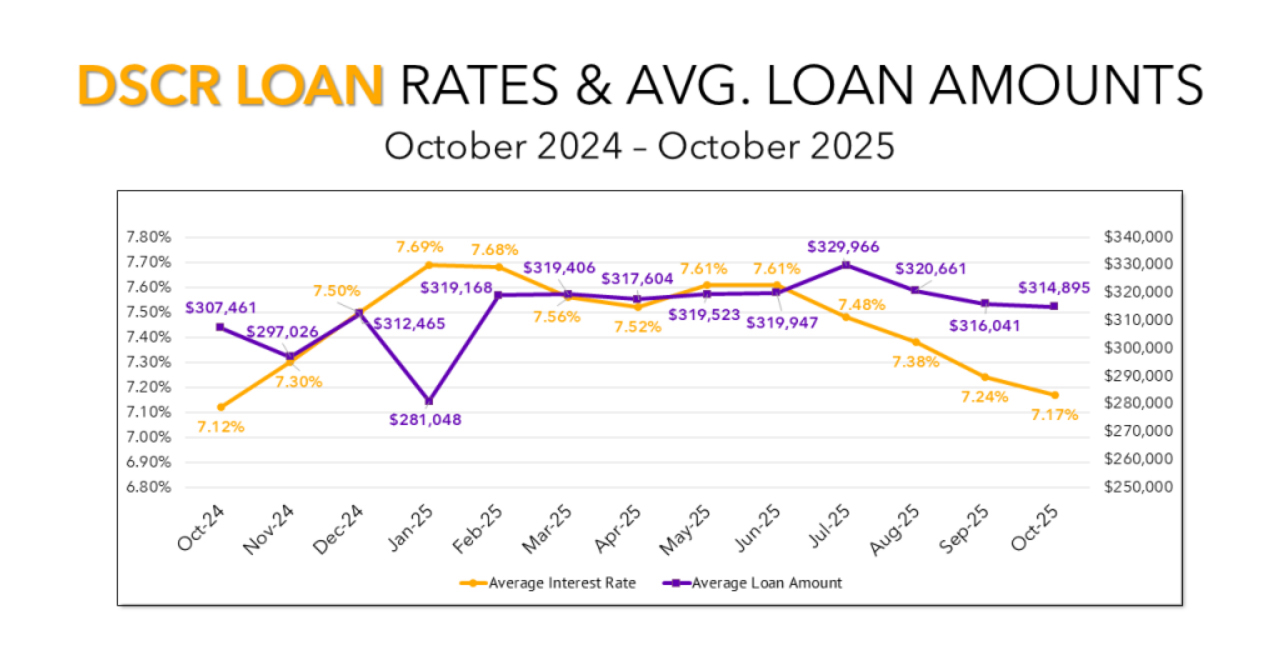

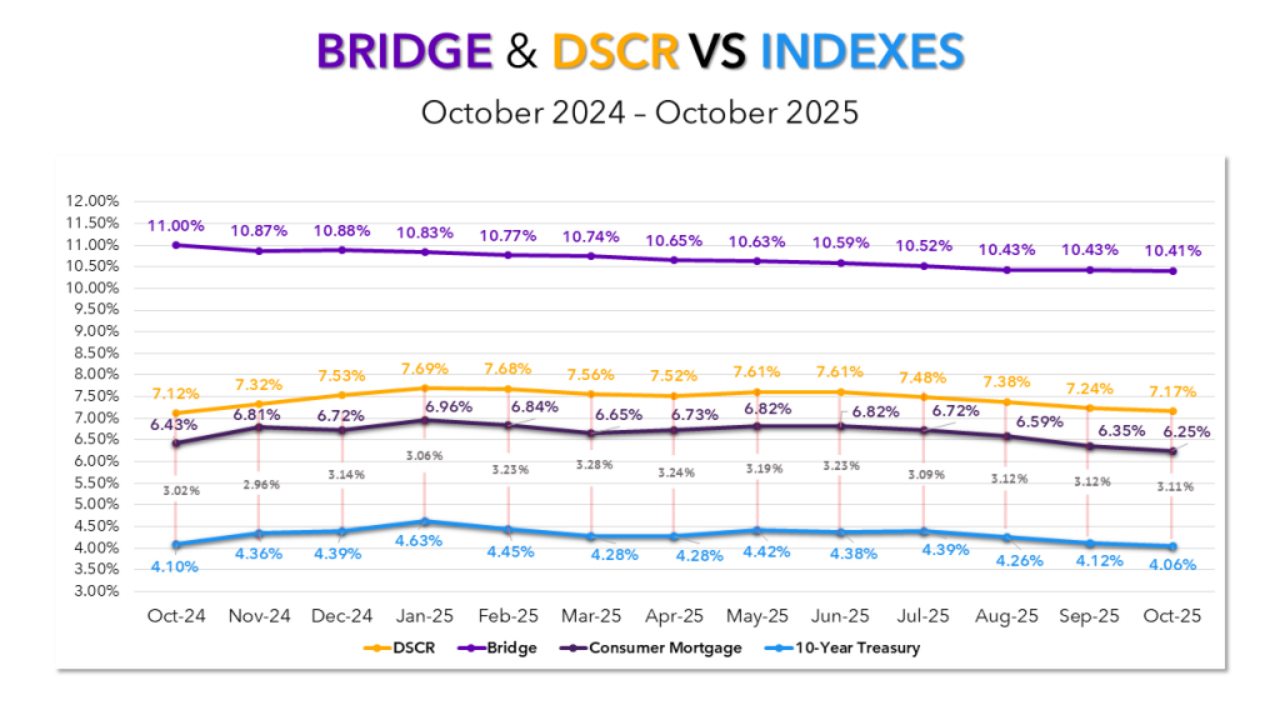

In October, the Federal Reserve lowered interest rates for the second consecutive month, and private lending rates followed suit. Both bridge and DSCR averages decreased, mirroring drops in key benchmark indices. Spreads between treasuries and DSCR rates continues to stay consistent showing that market appetite for the product remains robust.

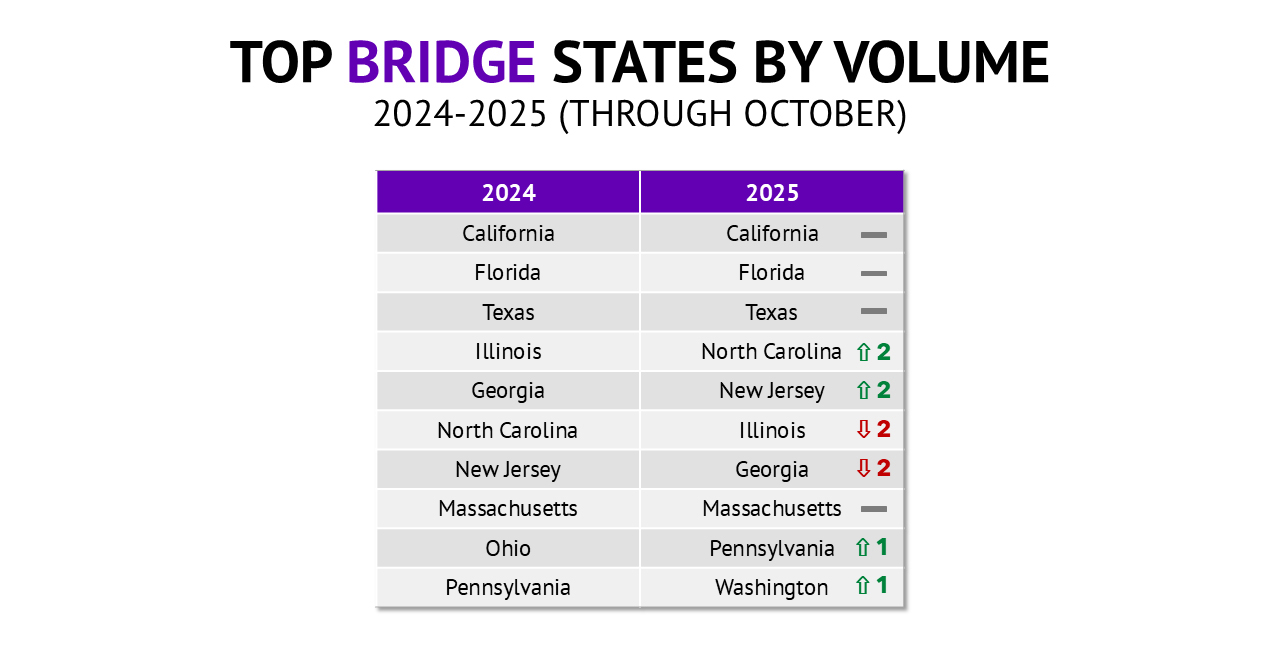

Opportunities Nationwide

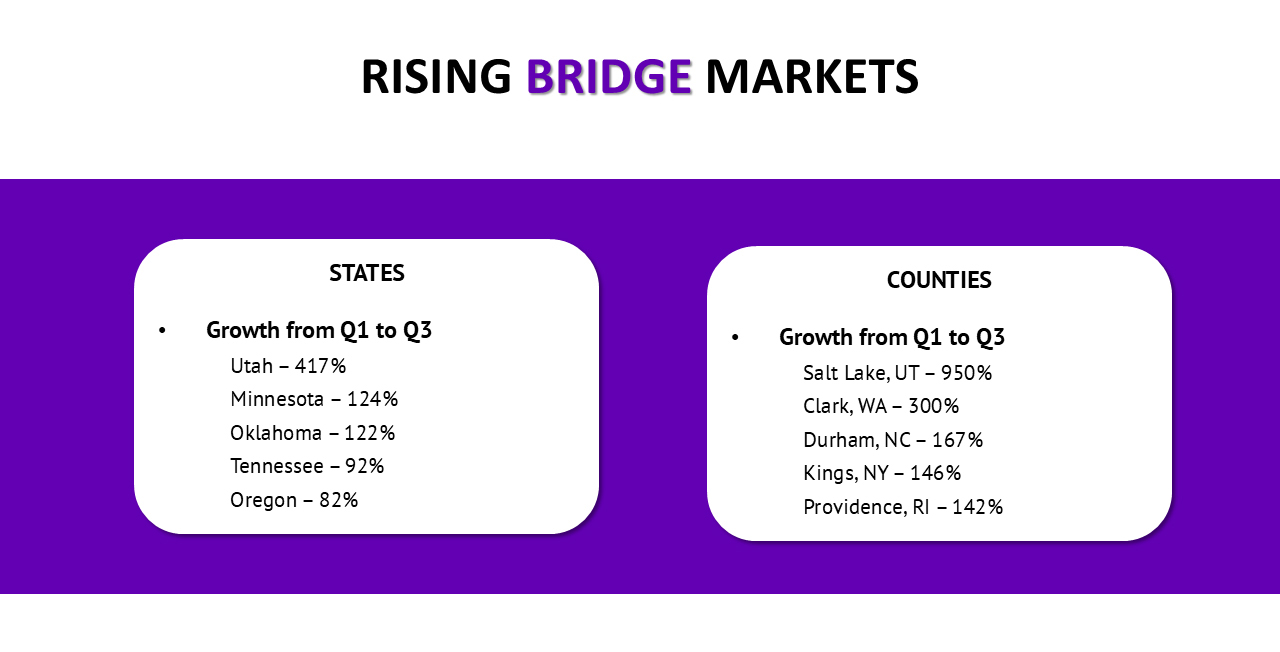

Even as overall loan volumes rise and established markets remain dominant, new regions are driving meaningful growth. From Hawaii to Alabama, lenders are expanding into untapped territories and finding new opportunities to scale their businesses.

Nema Daghbandan, Esq.

Founder and Chief Executive Officer of Lightning Docs

Lightning Docs is a proprietary cloud-based software which produces business purpose mortgage loan documents nationally. As a Real Estate Finance Attorney and Partner at Fortra Law, the nation’s largest private lending law firm, Mr. Daghbandan has unique expertise in understanding the needs of private mortgage lenders. Mr. Daghbandan has been recognized by his peers in the legal community as a Super Lawyers® Rising Star from 2016-2022. Only 2.5% of attorneys receive this distinction. He also received a perfect 10/10 rating from attorney review site AVVO®.