|

Getting your Trinity Audio player ready...

|

Summary

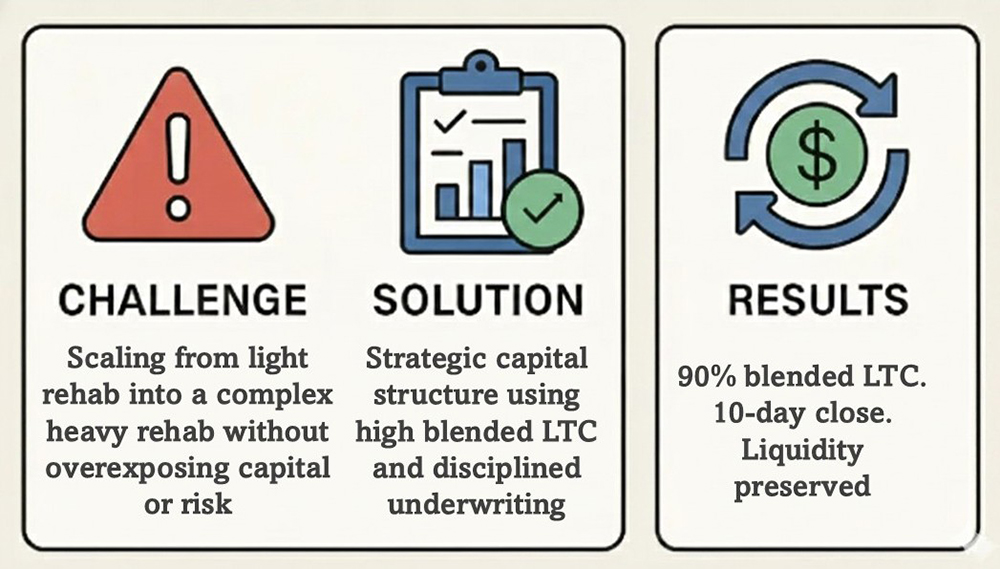

This case study highlights how Lorena Diaz, Capital Partner for Real Estate Investors at Lima One Capital, helped an experienced investor successfully scale from light rehab projects into a complex heavy rehab execution in Avondale Estates, Georgia. By strategically leveraging equity, structuring a high blended LTC loan, and delivering certainty of execution, Lorena enabled her client to confidently take on a significantly larger renovation while preserving liquidity and positioning the project for long-term growth.

Real Stories. Real Challenges. Real Solutions.

Every loan has a story behind the numbers.

In this section, The Elite Officer highlights real-world cases where Loan Officers turned complex challenges into successful closings. Each case shows how persistence, creativity, and financial strategy can make the difference between a stalled deal and a successful closing.

This project illustrates how the right capital partner can help investors responsibly expand their scope and elevate their portfolio.

The Deal at a Glance

- Property Type: Single-Family Residence (Fix & Flip)

- Location: Avondale Estates, Georgia

- Loan Amount: $730,000

- Rehab Type: Heavy Rehab

- Rehab Budget: $350,000

- Blended LTC: 90%

- Closing Timeline: 10 days

The Challenge

The borrower had a proven history completing light rehab projects, but this opportunity required a step up in both scale and execution risk. The project involved a significantly larger renovation budget and required confidence in managing a heavy rehab from acquisition through completion.

Key challenges included:

- Transitioning from cosmetic renovations to a full heavy rehab

- Preserving liquidity while taking on a larger scope

- Securing high leverage without compromising underwriting discipline

- Closing quickly in a competitive environment

Without the right structure, the investor risked overexposing capital or delaying execution.

The Solution

Lorena approached the transaction as a capital strategy, not just a loan.

As a Capital Partner for Real Estate Investors, she focused on aligning leverage, experience, and execution certainty. Her solution included:

- Structuring a 90% blended LTC loan that maximized leverage while remaining grounded in the project’s strong equity position

- Leveraging the projected after-repair value to support the borrower’s transition into a heavier rehab category

- Delivering a 10-day close, allowing the investor to secure the deal without disruption

- Providing clear guidance on underwriting expectations, construction risk, and draw management so the borrower could scale with confidence

Rather than viewing the investor’s lighter rehab background as a constraint, Lorena positioned it as a foundation—supported by disciplined capital and experienced execution.

The Outcome

The loan closed in just 10 days, allowing the investor to move forward with a $350,000 heavy rehab while preserving liquidity. The project is now positioned for a strong resale, with equity effectively leveraged to support both scale and profitability.

Takeaway for Loan Officers

- Capital partnership is key when investors scale into heavier rehabs

- Blended LTC can be a powerful tool when supported by strong equity

- Speed and certainty build trust and unlock opportunity

- Educating borrowers is critical when moving into more complex projects

Lorena Diaz

Capital Partner for Real Estate Investors | Lima One Capital

Lorena Diaz is a Capital Partner for Real Estate Investors at Lima One Capital, specializing in fix-and-flip and construction financing. She works closely with investors to structure strategic capital solutions that support portfolio growth, increase renovation complexity, and preserve liquidity at every stage of the investment lifecycle.