|

Getting your Trinity Audio player ready...

|

February 5, 2026.

When La Mesa Fund Control and Escrow (LMFCE) recently selected Sekady as their exclusive technology partner, the decision represented more than just another vendor agreement. It highlighted a fundamental shift in how fund control companies are addressing the operational challenges that have long plagued construction lending, and what forward-thinking lenders should demand from their fund control partners.

The Construction Draw Management Problem

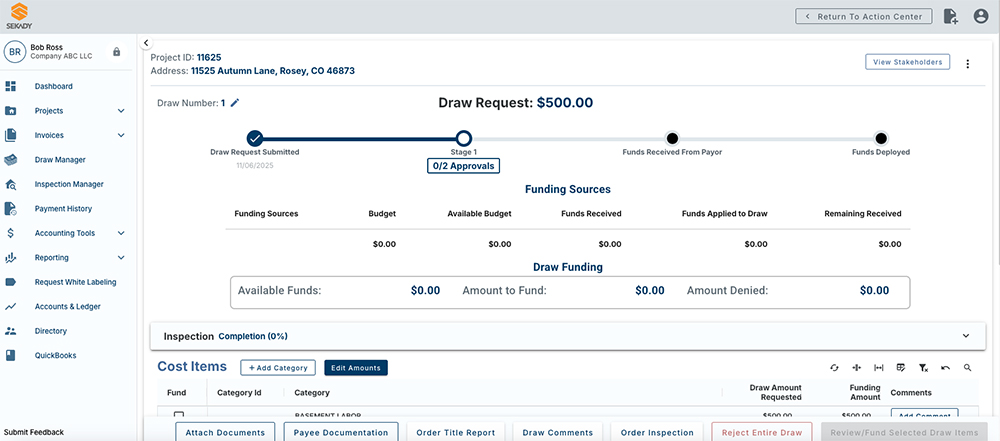

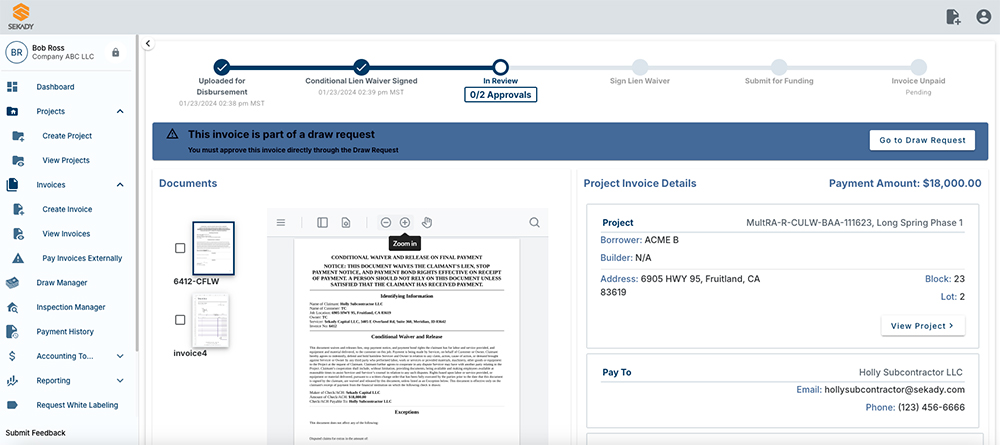

Construction lending remains one of the most operationally intensive segments of the private lending market. Each draw request triggers a cascade of manual tasks: document collection, inspection scheduling, budget verification, lien waiver tracking, and fund disbursement. All while maintaining rigorous security and compliance standards.

For most lenders, these processes still rely on emails, spreadsheets, and phone calls. Draw requests arrive via email. Inspectors use separate systems. Budget tracking happens in Excel. Lien waivers are chased manually. The result? Processing delays, communication breakdowns, and limited visibility precisely when lenders need transparency most.

These inefficiencies translate directly to operational costs and risk. When draw management is fragmented across multiple systems, critical details fall through cracks.

Why Sekady Won the Evaluation

La Mesa Fund Control’s selection of Sekady followed an extensive evaluation of multiple technology providers. According to Marcus Carter of LMFCE, three factors proved decisive.

Comprehensive functionality. Sekady addresses the entire construction draw lifecycle, from initial request through inspection coordination, budget management, lien waiver collection, and final disbursement, all within a unified system. For lenders, this eliminates chasing information across multiple platforms.

Enterprise-grade security. Sekady’s multi-layered infrastructure includes encryption, role-based access controls, and comprehensive audit trails-protections that institutional lenders require and that guard against fraud and compliance issues.

Rapid implementation. Carter specifically cited Sekady’s “remarkably smooth implementation process” as a key factor. LMFCE could begin serving clients quickly without the operational disruption that typically accompanies technology changes.

The Practical Benefits for Lenders

For construction lenders working with fund control partners using Sekady, the benefits materialize daily.

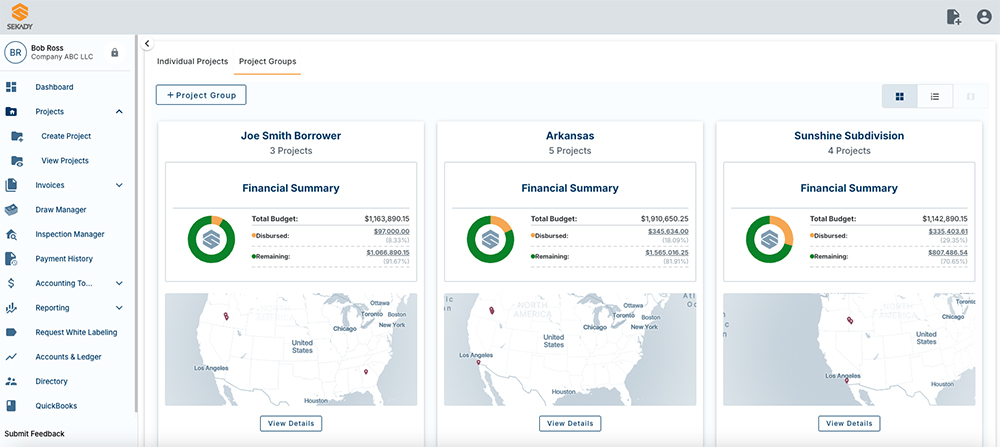

Real-time visibility. Lenders can see exactly where each project stands. Inspection status, budget disbursement percentage, and outstanding lien waivers, enabling proactive portfolio management and faster response when issues arise.

Automated workflows. When borrowers submit draw requests, the platform automatically routes them through approval chains and tracks required documentation. Nothing moves forward until all requirements are satisfied, while the overall timeline accelerates.

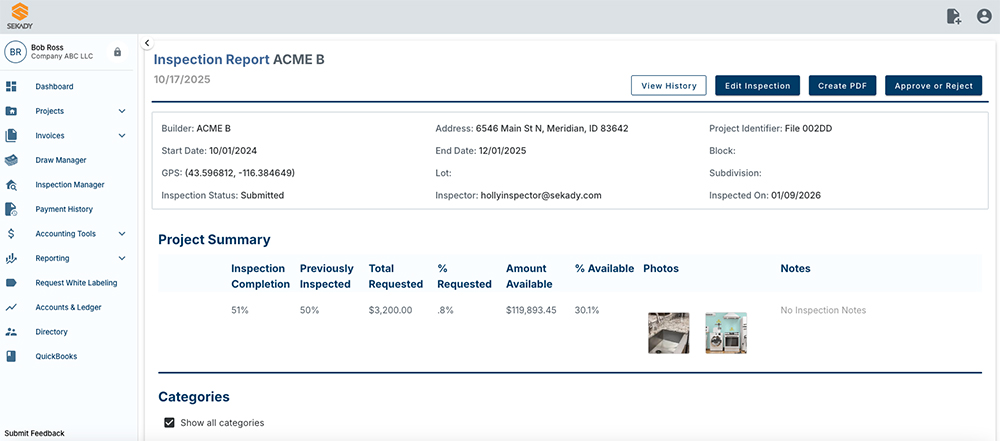

Seamless inspection management. Inspectors receive assignments, complete field work with photo documentation, and submit reports all within the same platform. Sekady is fully integrated with several key inspection providers, including La Mesa’s own network offering on-site, virtual, or remote inspections. Faster turnaround, better documentation.

Automatic compliance. Every action creates an audit trail. Every document is stored and version controlled. Every approval is time-stamped. When regulators ask questions or disputes arise, the complete history is instantly available.

The Competitive Advantage

As more fund control companies adopt comprehensive construction lending platforms like Sekady, lenders face a critical choice: continue working with partners using fragmented, manual processes, or demand the efficiency and visibility that modern technology enables.

The competitive implications are substantial. Lenders using fund control partners with advanced technology can process draws faster, provide better borrower experiences, and manage larger portfolios with the same team. They spot problems earlier and respond more quickly. They scale operations without proportionally scaling headcount. In a market where speed and reliability differentiate winners, technology infrastructure becomes competitive advantage.

Thayne Boren, President of Sekady, emphasized this alignment: “When organizations like LMFCE choose Sekady, it validates our focus on building solutions that combine powerful functionality with practical usability. This is exactly the kind of partnership that drives innovation in construction lending.”

Looking Forward

The La Mesa-Sekady partnership signals where the industry is heading. As construction lending continues to grow, the operational infrastructure supporting it must evolve beyond spreadsheets and email chains. Lenders increasingly recognize that their fund control partners’ technology capabilities directly impact their own competitiveness and client satisfaction.

For construction lenders evaluating fund control relationships or solutions, the questions are straightforward: If you perform your own fund control internally, does that process meet your needs? If you outsource, does your current fund control partner provide real-time visibility into project status? Can you process draws in days rather than weeks? Is documentation automatically organized and audit-ready? Can your borrowers track their project progress without constant phone calls?

If the answers are no, it’s worth asking why, and considering what partnerships like La Mesa and Sekady signal about industry expectations.

The construction lending market rewards those who can move quickly while maintaining rigorous controls. The technology infrastructure supporting those operations is no longer a nice-to-have, it’s competitive necessity. As borrowers become more sophisticated and competition intensifies, lenders who can deliver superior experiences through better operational technology will capture market share.

The question for construction lenders isn’t whether to demand better technology from fund control partners. It’s whether to lead this shift or follow it.